Are you tired of struggling to stay on top of your agency cashflow management? It’s time to take control.

With Allfred, you’ll experience real-time updates, automated forecasting, and data-driven insights to optimize your cash flow and make informed decisions. Don’t let it be a challenge anymore.

But before we hop into that, let’s break cashflow management down into prime factors.

What is cash flow management?

Cash flow management, in its simplest definition, is the process of managing money coming in and going out of your business. It’s a crucial part of running any successful organization, as it helps to provide insight into budgeting decisions and cash flow optimization.

Why is cash flow important so much?

Without proper cash flow management, even the most profitable company can quickly find itself in trouble. So, why is cash flow so vital for a company’s health? Let’s take a quick look.

Keeps your business afloat

Cash flow management is crucial for maintaining financial stability. It ensures that you have enough cash on hand to cover your immediate expenses, such as payroll, rent, and supplies. Without proper cash flow management, you could find yourself unable to meet these obligations, which could lead to serious financial trouble.

Enables investment in growth

Effective cash flow management means you’re not just surviving but thriving. With a healthy income, you can invest in opportunities for growth, such as launching new products or expanding into new markets.

Provides a buffer for unexpected expenses

Life is full of surprises, and so is business. Unexpected expenses can pop up at any time, and if you’re not prepared, they can put a serious strain on your finances. Good cash flow management includes planning for these contingencies, giving you a financial buffer that can help you weather the storms.

Enhances relationships with stakeholders

Managing your cash flow effectively can help enhance your relationships with stakeholders. Suppliers appreciate timely payments, employees value a stable paycheck, and investors are more likely to support a business that demonstrates financial stability.

How are cash flows different than revenues?

Cash flows and revenues are two financial metrics that, while interconnected, serve different purposes and provide different insights into a business’s financial health.

Cash flows

Cash flows represent the actual inflow and outflow of cash in a business. It’s the money that physically comes in from sales or goes out for expenses. Cash flows give a clear picture of a company’s liquidity – its ability to cover its immediate expenses. They’re crucial for understanding whether a business has enough cash to stay afloat day-to-day.

Revenues

Revenues, on the other hand, represent the total amount of money a business earns from its operations, regardless of when the cash is received.

For example: If a company makes a sale on credit, it recognizes the revenue from that sale immediately, even though it may not receive the cash until later. Revenues give an indication of a company’s earning potential and overall profitability.

In essence, the difference between cash flows and revenues is a matter of timing and liquidity. Revenues show how much a company earns, while cash flows show when those earnings actually turn into cash that the company can use.

What is good cash flow management?

Do you want to stay in business? You need to be operating cash flow like a pro – especially in these turbulent times when small business cash flow issues are common and there is not much cash in the market.

Timing is everything

In positive cash flow management, timing is everything. It’s about coordinating when money comes in from customers with when it needs to go out for expenses. This might involve negotiating terms with suppliers or offering incentives for customers to pay early.

Keeping a close eye on the numbers

A good cash flow forecast also involves closely monitoring your free cash flow. This means regularly reviewing cash flow statements, forecasting future cash flows, and being alert to any changes that could impact cash flow analysis. How much cash has been generated? What are your business expenses? What is the net amount of cash at your disposal? How is your line of credit looking?

It is here that budgeting software comes into play. Such solutions as Allfred provide the features you need to accurately track your business cash and allocate the resources. For example, Allfred clear dashboard helps you track the expenses in real-time and aware you whenever you exceed the budget.

Maintaining a cash buffer

Just as a dancer always has a backup plan in case something goes wrong during a performance, good cash flow management includes maintaining an extra cash buffer for unexpected expenses. Even a little amount of cash provides a safety net that can help the business weather financial surprises – for both cash inflows and outflows.

Making strategic decisions

Good cash flow management involves using your understanding of your cash flow to make strategic decisions. This could involve deciding when to invest in new equipment, when to expand, or when to tighten spending. Even a negative cash flow gives you a lot of insights on how to… improve cash flow for the future.

How do you solve agency cashflow problem? – Manage your cash flow

If you run into cash flow problems because of your poor cash flow management, remember – there is no situation without a solution. Good cash flow management requires understanding and analyzing your current position, assessing the potential risks, and making changes to how small business owners and agencies manage cash flow and strategy.

#1 Speed up receivables

If slow-paying customers are causing cash flow issues, look for ways to encourage faster payment. This could involve offering discounts for early payment, requiring deposits for large orders, or simply following up promptly on overdue invoices.

#2 Manage payables

On the flip side, you can improve cash flow by managing your payables. So, you could try negotiating longer payment terms with suppliers or taking full advantage of the terms that are offered. Whatever works best for you (and your cash balance).

#3 Improve inventory management

If a lot of your cash is tied up in inventory, improving inventory management can free up cash. This might involve decreasing stock levels, improving forecasting to prevent overstocking, or finding ways to sell off slow-moving items.

#4 Increase sales

Of course, one of the most effective ways to improve cash flow is to increase sales. Consider starting marketing efforts to attract new customers, introducing new products or services, or finding ways to upsell or cross-sell to existing customers – all to improve your “cash position.”

#5 Secure financing

If cash flow problems are due to a temporary shortfall, securing short-term financing can help bridge the gap. Consider securing a business line of credit, short-term loan, or invoice financing to address this.

Why should you use cash flow management software?

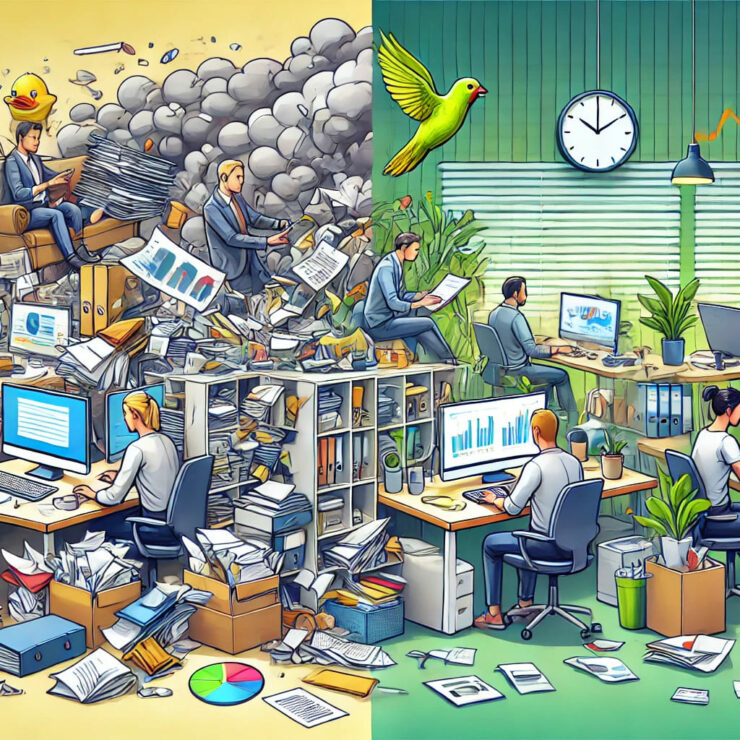

Cash is flowing. All is right. Until… there is no cash available. Or simply, less cash for business growth.

How did it happen?

Well, while basic calculations might have been sufficient in the early stages of your business, as you grow, the complexity of managing cash flow grows with it.

That’s where finance management software steps in.

- It automates the process, reducing the risk of human error and saving valuable time.

- It provides real-time updates, giving you a clear and current picture of your financial status at any given moment.

- The software can also forecast future cash flow based on historical data and current trends, allowing you to plan and make strategic decisions proactively.

Manage your cash flow efficiently with Allfred

Allfred is more than just a workflow platform – it’s your financial compass, guiding you toward efficient cash flow management. This platform is like your personal CFO, helping you navigate through the financial landscape of your ad agency.

Automated budgeting and resource planning 📊

Allfred takes the guesswork out of budgeting and resource planning. It automates these processes, ensuring you allocate your resources effectively and stick to your budget. No more overspending or underutilizing resources = more cash you have on hand for running your business.

Comprehensive project management 🎯

From start to finish, Allfred keeps a close eye on your projects. It tracks project costs in real time, helping you stay on top of your expenses and maintain positive cash flow for your business.

Transparent documentation 📖

Allfred allows for keeping your financial documents, such as invoices, contracts, and project plans, in one centralized place. This allows for easier organization and accessibility of all your financial documents. With just a few clicks, you can find what you need without having to search through stacks of paper.

Data-driven financial decisions 📈

With Allfred, all your agency data is at your fingertips. It provides valuable insights into your financial performance, enabling you to make informed decisions that help you avoid cash shortages.

Seamless team collaboration 🤝

Allfred fosters effective team collaboration, ensuring everyone is on the same page when it comes to financial matters (and tasks). You can both analyze cash flow as it plays a role of accounting software, but also run brainstorming and planning when it comes to resources and time.

Start boosting cash flow strategies!

Cash flow management strategies, business operations, financial obligations, business conditions… for many small business owners or agency businesses afloat, it’s a lot of tasks on the plate to handle. Fortunately, there are software solutions that can help you monitor the cash flow of your business.

Cash flow is the lifeblood of your business. Love it or hate it – that’s the truth. Ensure your business is prepared for any financial challenges with cash flow analysis and forecasting tools. It helps you understand your current condition, plan better for the future, and optimize your cash flow to ensure you have enough cash in the bank to meet all of your obligations. Or, if not – that you know how to generate cash in your agency.

Ready to start managing your cash flow effectively? Book a demo and see Allfred budgeting software in action!